Corporate Governance

Basic Views on Corporate Governance

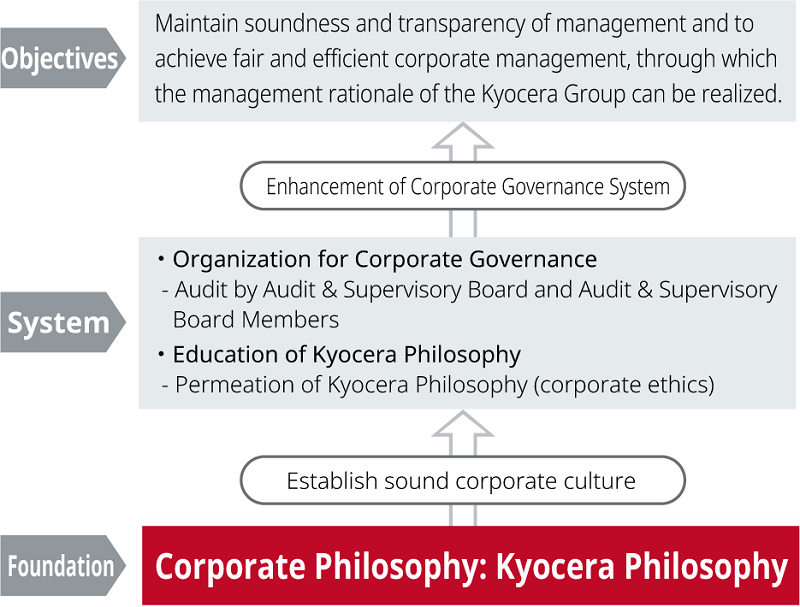

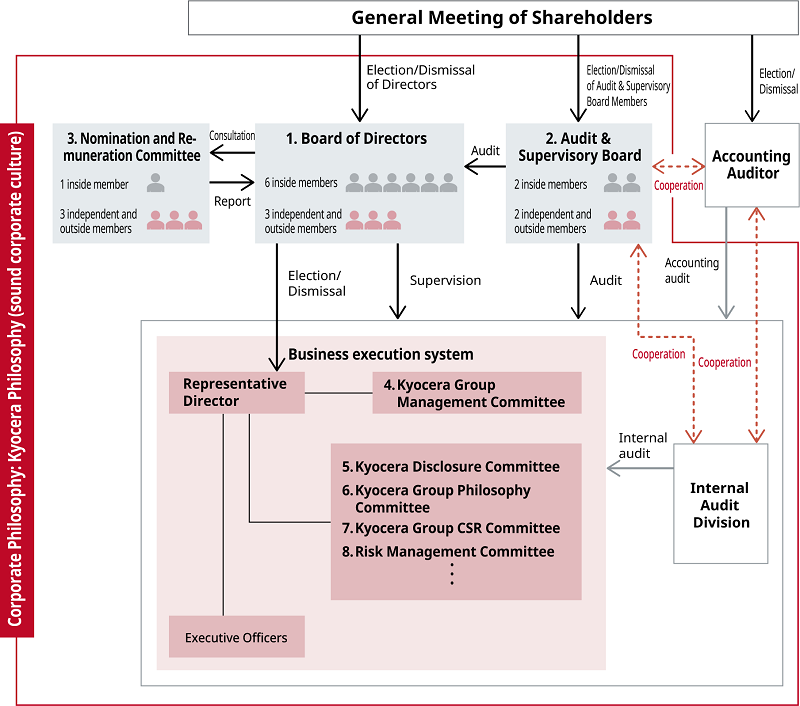

The Board of Directors of Kyocera defines the corporate governance of the Kyocera Group to mean "structures to ensure that Directors conducting the business manage the corporations in a fair and correct manner". The purpose of corporate governance is to maintain soundness and transparency of management and to achieve fair and efficient corporate management, through which the management rationale of the Kyocera Group can be realized. The Board of Directors shall permeate the "Kyocera Philosophy," which is the basis of the management policy of Kyocera Group, in all Directors and employees working in Kyocera Group, and establish a sound corporate culture. The Board of Directors shall establish proper corporate governance through the exercise of the Kyocera Philosophy.

1.Board of Directors

The Board of Directors of Kyocera is an organization to decide the important matters and supervise the execution of businesses of Kyocera Group as a whole. It consists of nine Directors including three are Outside Directors.

The Directors are nominated by the General Shareholders Meeting based on the proposal of candidates who have enough understanding of Kyocera Group and with outstanding "personal qualities", "capability" and "insight" to engage in the management of Kyocera. The Board of Directors met twelve times in the year ended March 31, 2022.

2. Audit & Supervisory Board

The Audit & Supervisory Board consists of four members. Audit & Supervisory Board Members include two full-time Audit & Supervisory Board Members, originally employees of Kyocera, as well as two Outside Audit & Supervisory Board Members, who have plenty of knowledge and experience as an attorney-at-law or CPA.

The Audit & Supervisory Board Members are conducting audit of Kyocera as a whole based on the accurate information about Kyocera gathered from inside and utilizing variety of viewpoints as outsiders of Kyocera. The Audit & Supervisory Board met nine times in the year ended March 31, 2022.

3. Nomination and Remuneration Committee

As consulting organization of the Board of Directors, Kyocera has established the Nomination and Remuneration Committee, the majority of which consists of Outside Directors.

The Board of Directors examines nomination of Directors and Managing Executive Officers and remuneration of Directors after consulting in advance the Nomination and Remuneration Committee so that the decision relating thereto shall be made in a fair manner and appropriately. The Nomination and Remuneration Committee met twice in the year ended March 31, 2022, deliberating and responding to requests for consultation from the Board of Directors.

4. Kyocera Group Management Committee

Kyocera has established the Kyocera Group Management Committee consisting of Representative Director and Chairman, Representative Director and President and Managing Executive Officers who live in Japan and Kyocera holds meetings every month regularly. Such Committee examines not only the agenda of the meetings of the Board of Directors but also other important matters relating to the execution of the businesses of Kyocera Group as a whole to secure the sound management of Kyocera Group. The Kyocera Group Management Committee met twenty-three times in the year ended March 31, 2022.

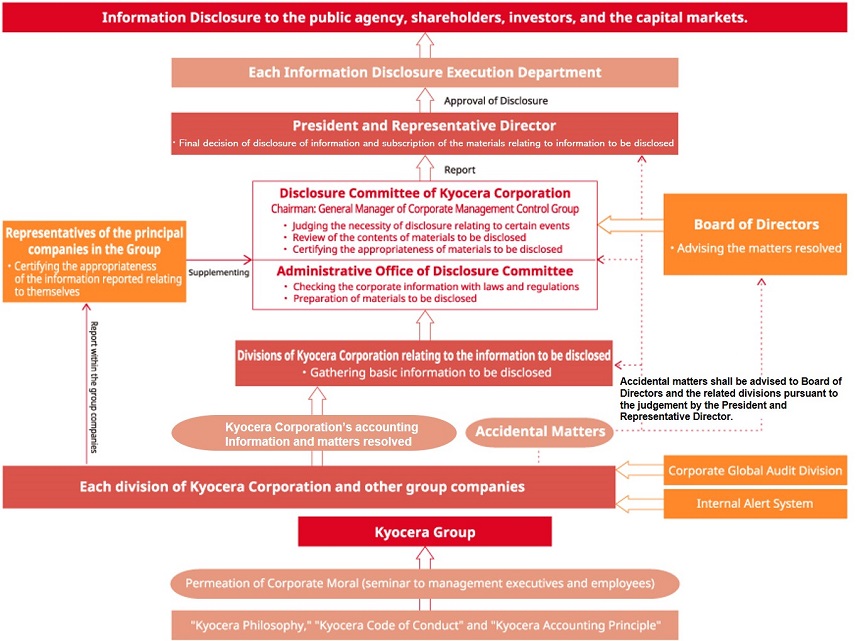

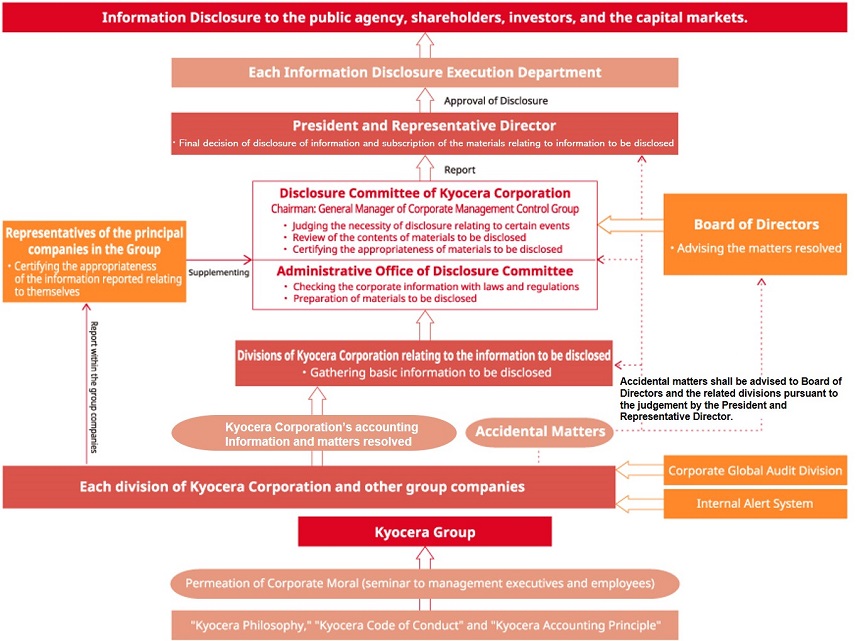

5. Kyocera Disclosure Committee

Kyocera has established an organ known as the the Kyocera Disclosure Committee for disclosure of corporate information. This Committee investigates all disclosure documents for the purpose of assuring the appropriateness of disclosures of corporate information, reporting the results of its investigations to the Representative Director and President which educates Group companies concerning rules relating to disclosure and promotes appropriate disclosure of information for the entire Group. The Kyocera Disclosure Committee met four times in the year ended March 31, 2022.

6. Kyocera Group Philosophy Committee

Kyocera has established the Kyocera Group Philosophy Committee to educate and permeate "Kyocera Philosophy," which is our

corporate philosophy setting forth the importance of conducting business of management in a fair and honest way, basing its fundamental judgments on a precept that "What do we consider to be the right choice as a human being?" The Committee has set education policy of "Kyocera Philosophy" of each entity in Kyocera Group, and discusses and decides the measures to promote an understanding of "Kyocera Philosophy" and practice it.

The Kyocera Group Philosophy Committee met twice in the year ended March 31, 2022.

7. Kyocera Group CSR Committee

Kyocera has established the Kyocera Group CSR Committee to deliberate on a business strategy that will contribute to the resolution of societal needs, and policies and targets related to social requirements in an aim to realize our Management Rationale and achieve the SDGs. The Committee is headed up by the Representative Director and President, and is composed of Directors and other members of top management. The Kyocera Group CSR Committee met twice in the year ended March 31, 2022.

8. Risk Management Committee

Headed by the Representative Director and President, the Risk Management Committee was established to determine risk management policies, and to identify corporate risks that need to be addressed by the Group.

Initiatives for Strengthening Corporate Governance

Composition of the Board of Directors

Views on the Balance, Diversity and Size of the Board of Directors

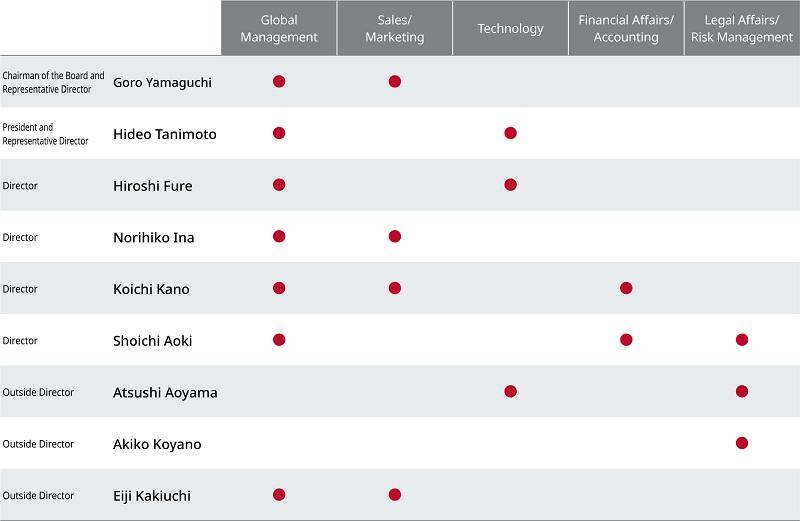

Kyocera considers that the Board of Directors must be equipped with the following skills from 1 to 5 to be able to suggest general directions of the Kyocera Group's growth strategies, discuss the appropriateness, risks, and other factors of such directions from objective and diverse perspectives, and appropriately oversee the status of business operations.

1. Global management

2. Sales / Marketing

3. Technology

4. Financial affairs / Accounting

5. Legal affairs / Risk management

The Key skills possessed by the current Directors are presented in the table below.

Kyocera's nomination policy for the appointment of Directors is to balance the skills required of the Board of Directors and ensure diversity, including race, ethnicity, gender, nationality, work experience, and age groups on the assumption of electing individuals having an adequate understanding of the Kyocera Group, who in terms of managing the Kyocera Group excel in their "personal qualities," "capability" and "insight." Based on such policy, the Board of Directors is well balanced in skills and it is constituted in a manner to achieve both diversity and appropriate size. Kyocera elects one independent Outside Director with management experience in other companies.

The Key Skills Possessed by the Current Directors

Efforts to Improve the Effectiveness of the Board of Directors

Establishment of the Nomination and Remuneration Committee

Kyocera has established a Nomination and Remuneration Committee to ensure the objectivity and transparency of the procedures to determine nomination and remuneration. The Nomination and Remuneration Committee adequately deliberates on the nomination of the senior management and Directors (including succession plans), their remuneration, and other important matters, taking into account perspectives such as gender and other types of diversity and personal skills. The policy, mandates, roles, and other elements of the independence of the composition of Kyocera's Nomination and Remuneration Committee are as follows:

<Policy of Independence of the Composition>

Independent Outside Directors comprising a majority of the Committee members ensure its independence.

<Mandates and Roles>

In response to inquiries of the Board of Directors, the Committee deliberates on 1, matters concerning the appointment and dismissal of Directors, 2, matters concerning remuneration of Directors, and 3, matters concerning the appointment and dismissal of executive officers and reports the results to the Board of Directors. Beyond such inquiries, the Committee also provides the Board of Directors with advice as appropriate.

Evaluation of the Effectiveness of the Board of Directors

Kyocera analyzes and evaluates the effectiveness of the Board of Directors as a whole in order to obtain an appropriate understanding of the current condition of the Board of Directors and to achieve more effective operation.

<Outline of Effectiveness Evaluation Implemented in FY2022>

1.Evaluation Method

Kyocera conducted an effectiveness evaluation questionnaire to all Directors and all Audit & Supervisory Board Members.

2.Questionnaire Items

Kyocera conducted quantitative and qualitative evaluations based on a four-point scale and free descriptions regarding (1) through (4) below.

- Administration and deliberation of the Board of Directors (Provision of information, agenda items, frequency of meetings, time for deliberations, free and open discussions and exchanges of views, support from the secretariat, etc.)

- Composition of the Board of Directors (Size, member balance, diversity, etc.)

- Roles and Responsibilities of the Board of Directors (Discussion of the broad direction of corporate strategy, oversight of the management, management of subsidiaries, etc.)

- Optional Nomination and Remuneration Committee (Agenda items, frequency of meetings and time for deliberations)

3.Summary of Evaluation Results and Future Initiatives

As a result of the above evaluations, we confirmed that the effectiveness of the Board of Directors has been generally ensured, and that the following points have been evaluated in particular:

- The composition of the Board of Directors was changed last year and the number of Internal Directors was reduced. This has resulted in a more appropriate size and composition of the Board of Directors.

- Reports on current status and strategies of the business were presented to Outside Directors multiple times throughout the year. This has helped to deepen their understanding of Kyocera's business and has increased opportunities for them to exchange opinions with the Executives.

In addition, the Board of Directors has been working to improve the issues identified in the previous evaluations by enhancing explanations on business strategies and providing more information. Based on the results of the evaluations of this time, the Board of Directors will promote the following initiatives to further improve its effectiveness:

- Further enhance agenda items related to internal control and risk management, as well as shareholders and investors' opinions.

- Increase the weight of discussions on the direction of Kyocera Group, including company-wide strategies and deepen those discussions.

Training for Directors and Audit & Supervisory Board Members

The Directors and Audit & Supervisory Board Members are given, at the time of their assumption of their office, explanations concerning the details of the business of Kyocera and their respective roles and responsibilities as considered necessary in order for them to perform their roles and fulfill their responsibilities. Further, even after assuming office, if a Director or Audit & Supervisory Board Member requests, training tailored to meet the individual requests are given and opportunities for advancement of necessary knowledge are offered or introduced, or financial support for the necessary expenses for such purposes are provided, according to their individual situations.

Involvement in Succession Planning

The Board of Directors is actively involved in the establishment and implementation of a succession plan for Executives based on Kyocera's objectives (such as the management rationale) and specific management strategies. Appropriate monitoring is also conducted to ensure that sufficient time and resources are dedicated to the systematic development of candidates for succession. In addition, we have established an Executive Officer system to ensure the effective and efficient operation of the business execution system. One of the objectives of this Executive Officer system is to plan the development of the next generation of executives by actively identifying managers who display outstanding humanity and ability to take charge of the future management of Kyocera.

In line with this purpose, the Board of Directors checks the development of future Executives every year and determines the appointment of Executive officers based on these findings.

Current Initiatives for the Enhancement of the Functions of the Audit & Supervisory Board Members

Current initiatives for the enhancement of the functions of the Audit & Supervisory Board Members are as follows:

- Allocating certain employees who are selected from Corporate Global Audit Division upon the request of the Audit & Supervisory Board Members, through prior discussion with the Audit & Supervisory Board Members, to assist in their tasks and the Audit & Supervisory Board.

- Holding regular meetings with Representative Directors to exchange opinions relating to the management of Kyocera as a whole;

- Holding regularly the "Kyocera Group Audit & Supervisory Board Members Meeting" where all audit & supervisory board members of companies within Kyocera Group gather to report and discuss the condition of auditing the legality of the business execution and the status of the internal control of the directors of the companies within Kyocera Group;

- Establishing the system called "Whistleblower System to Kyocera Audit & Supervisory Board" so that the related parties with Kyocera can directly submit complaints to the Audit & Supervisory Board;

- Holding regular meetings with accounting auditors to discuss about the audit plan and substance of quarterly audit and result of the audit, and exchanging information and opinions as necessary from time to time;

- Holding meetings in a timely fashion with internal audit division of Kyocera in order to evaluate and monitor whether the business of the Kyocera Group is duly and efficiently executed in accordance with the laws and regulations and internal rules of Kyocera; and

- Nominating two Outside Audit & Supervisory Board Members who are independent and not to have any conflict of interest with the shareholders in general of Kyocera.

Outside Directors and Outside Audit & Supervisory Board Members

Functions and roles of Outside Directors and Outside Audit & Supervisory Board Members

Kyocera has strengthened the supervisory function of the Board of Directors and audit function of Directors by appointing three Outside Directors with extensive knowledge and experience as a professor of graduate School, as an attorney-at-law, or as a person with management experience, and two Outside Audit & Supervisory Board Members with extensive knowledge and experience as an attorney-at-law, or as a certified public accountant and having the Directors provide sufficient explanations to the Outside Directors and Outside Audit & Supervisory Board Members at meetings of the Board of Directors and other meetings. In addition, Directors make decisions with an external perspective by exchanging opinions with Outside Directors and Outside Audit & Supervisory Board Members on overall management. Furthermore, Kyocera has established a sound corporate culture pursuant to the "Kyocera Philosophy, "which is the corporate philosophy based on the general criteria in making judgment, namely "What do we consider to be the right choice as a human being?"Kyocera establishes its corporate governance system through practicing the Kyocera Philosophy. Such system is supplemented by the function to check the management by the Outside Directors and Outside Audit & Supervisory Board Members.

Activities of Outside Directors and Outside Audit & Supervisory Board Members During FY2022

| Name | Main activities |

|---|---|

| Outside Directors | |

| Atsushi

Aoyama Independent Director Member of the Nomination and Remuneration Committee |

He attended all 12 meetings of the Board of Directors. At meetings of the Board of Directors, he actively expressed his views particularly from the standpoint of technology management based on his abundant knowledge and experience as a Professor of Graduate School and played the role in giving precise advice and supervision of general corporate activities of Kyocera. He also attended both of two meetings of the Nomination and Remuneration Committee as a member of the Committee and provided a supervising function in the process of determining candidates for Directors and Executive Officers, Directors' compensation, and other matters from an objective and neutral position. |

| Akiko Koyano Independent Director Member of the Nomination and Remuneration Committee |

She attended all 12 meetings of the Board of Directors. At meetings of the Board of Directors, she actively expressed her views particularly from the legal standpoint and the standpoint of diversity based on her abundant knowledge and experience as an Attorney-at-law and played the role in giving precise advice and supervision of general corporate activities of Kyocera. She also attended both of two meetings of the Nomination and Remuneration Committee as a member of the Committee and provided a supervising function in the process of determining candidates for Directors and Executive Officers, Directors' compensation, and other matters from an objective and neutral position. |

| Eiji Kakiuchi Independent Director Member of the Nomination and Remuneration Committee |

He attended all 10 meetings of the Board of Directors. At meetings of the Board of Directors, he actively expressed his views particularly from the standpoint of business and management strategies based on his abundant knowledge and experience as a person with management experience and played the role in giving precise advice and supervision of general corporate activities of Kyocera. He also attended both of two meetings of the Nomination and Remuneration Committee as a member of the Committee and provided a supervising function in the process of determining candidates for Directors and Executive Officers, Directors' compensation, and other matters from an objective and neutral position. |

| Outside Audit & Supervisory Board Members | |

| Hitoshi Sakata Independent Audit & Supervisory Board Member |

He attended all 12 meetings of the Board of Directors and all 9 meetings of the Audit & Supervisory Board. At meetings of the Board of Directors and the Audit & Supervisory Board, he actively expressed his views particularly from the legal standpoint based on his abundant knowledge and experience as an Attorney-at-law. |

| Masaaki Akiyama Independent Audit & Supervisory Board Member |

He attended all 12 meetings of the Board of Directors and all 9 meetings of the Audit & Supervisory Board. At meetings of the Board of Directors and the Audit & Supervisory Board, he actively expressed his views particularly from the standpoint of finance and accounting based on his abundant knowledge and experience as a Certified Public Accountant. |

Thoughts of Kyocera with Respect to the Independence of Outside Directors and Outside Audit & Supervisory Board Members

Kyocera thinks that it is important to retain persons who have outstanding "personality," "capability" and "insight" as Outside Directors and Outside Audit & Supervisory Board Members of Kyocera and to have such persons supervise and audit Kyocera's management from an objective point of view.The Outside Directors and Outside Audit & Supervisory Board Members of Kyocera are selected as independent Directors and independent Outside Audit & Supervisory Board Members compliance with the following "Independence Standards for Outside Directors and Outside Audit & Supervisory Board Members," which Kyocera established, in addition to the requirements concerning the Outside Directors and Outside Audit & Supervisory Board Members prescribed by the Companies Act and the independence standards prescribed by the financial instruments exchanges.

[Independence Standards for Outside Directors and Outside Audit & Supervisory Board Members]

The Company judges that an Outside Director and an Outside Audit & Supervisory Board Member who is not fallen under any of the following items is independent of the Company.

- An executive (note 1) of the Group (note 2)

- A person who has been an executive (including a non-executive Director when judging the independence of an Outside Audit & Supervisory Board Member) of the Group in the past 10 years (note 3).

- A major business partner of the Group (a business partner whose payments to the Group or payments received from the Group in the most recent fiscal year represent 2% or more of the consolidated net sales of either the Company or the business partner) or an executive thereof.

- A person who is a consultant, accounting professional or legal professional who receives a large amount of monetary consideration or other property (10 million yen or more per year in the case of individuals, and 2% or more of the total income per year in the case of a body) from the Group, besides remuneration as a Director or an Audit & Supervisory Board Member.

- A person who belongs to audit firms which are the Accounting Auditors of the Group.

- A person who receives a large donation or subsidy (donation or subsidy of an amount equal to or more than 10 million yen or 2% of the total income of the person per year, whichever is greater) from the Group or an executive thereof.

- A major shareholder (a shareholder who holds shares with 5% or more of total voting rights at the end of the most recent fiscal year) of the Company or an executive thereof.

- An executive of the company which accept Directors or Audit & Supervisory Board Members (both full-time and part-time) from the Group, its parent companies or subsidiaries (except when the company, its parent companies or subsidiaries belong to the Group).

- A person who has fallen under any of items (3) through (8) above in the past three years.

- A spouse or relative within the second degree of kinship, of a person who falls under any of items (1) through (9) above (limited to the person in an important position (note 4)).

- Any other person who is likely to have serious conflicts of interest with general shareholders.

notes

- An "executive" means an Executive Director, Operating Officer, Executive Officer or other person or employee similar thereto.

- "The Group" means the Company or its subsidiaries.

- When judging the independence of an Outside Director who was a non-executive Director or an Audit & Supervisory Board Member of the Group (in the case of an Outside Audit & Supervisory Board Member who was an Audit & Supervisory Board Member of the Group) at any time in the past 10 years, "the past 10 years" means the 10 years prior to his or her appointment to those positions.

- An "important position" means a Director, Audit & Supervisory Board Member, Executive Officer, Operating Officer, other person similar thereto, or an employee who executes important operations, such as a general manager.

Remuneration of Directors and Audit & Supervisory Board Members

Directors

"Decision Policy Regarding the Details of Individual Remuneration for Directors"

Basic policy

- The remuneration system for Directors is designed to be a mechanism that effectively encourages Directors to thoroughly demonstrate their abilities and fulfill their roles and responsibilities toward the healthy and sustainable growth of the Kyocera Group.

- The remuneration level of Directors shall be set at an appropriate level by referring to objective data from external specialist organizations while giving consideration to securing and maintaining excellent human resources necessary for realizing the management rationale.

- Regarding the remuneration system and remuneration level of Directors, high objectivity and transparency in the process for determining remuneration for Directors shall be assured by making decisions according to a resolution by the Board of Directors based on the deliberations with and reports from the Nomination and Remuneration Committee, which consists of a majority of Outside Directors.

| Basic Remuneration | Bonuses to Directors (Performance-linked remuneration) |

Restricted Stock Compensation (Non-monetary remuneration) |

|

|---|---|---|---|

| Applicable to: | Directors | Directors (excluding Outside Directors) | Directors (excluding Outside Directors) |

| Items determined at General Meeting of Shareholders | <The 55th Ordinary General Meeting of Shareholders

held on June 25, 2009> No more than 400 million yen per year (not including salaries for services as employees or Executive Officers for those Directors who serve as such). |

<The 55th Ordinary General Meeting of Shareholders

held on June 25, 2009> Not exceed 0.2% of the consolidated net income* of Kyocera for the relevant fiscal year, provided that such amount of bonuses shall in no case exceed 300 million yen annually. |

<The 65th Ordinary General Meeting of Shareholders

held on June 25, 2019> No more than 100 million yen per year as well as no more than 0.1 % of the profit attributable to owners of the parent as the reasonable amounts and that the number of shares shall be no more than 25,000 shares per year. |

| Details |

●Monetary remuneration to be paid according to the responsibilities of the Directors. ● Individual payment levels of the payment amount will be determined according to each respective role upon taking into consideration the payment levels of other companies in the same industry. ● The annual amount shall be paid monthly in 12 equal portions. |

● Monetary remuneration to be paid according to the degree of contribution of each Director to business results in the relevant fiscal year ● The performance indicator is "profit attributable to owners of the parent." This is calculated by multiplying the numerical value determined based on this performance indicator by a prescribed coefficient according to the position of the Director and a coefficient for individual assessment according to the degree of contribution to performance. ● Provided once per year following the end of the business year. |

● Remuneration to be provided Kyocera's common stock (restricted stock) for the purpose of further sharing value with shareholders while granting incentives to continuously improve the medium-to-long-term corporate and shareholder value. ● The amount to be paid to each Director shall be determined by position. ● Granted once a year in each business year |

Notation changed to "Profit attributable to owners of the parent" as per the adoption of the International Financial Reporting Standards (IFRS).

Views on Remuneration Proportion

- Based on the belief that a system for the healthy and sustainable growth of the Kyocera Group is important, the proportion of basic remuneration and restricted stock compensation is determined placing emphasis on the level and stability of basic remuneration as well as giving consideration to the pursuit of shareholder interests. Moreover, the higher the position of the Director, the higher the proportion of the restricted stock compensation to basic remuneration.

- For bonuses to Directors, to ensure maximize incentives for growing business results, no limit shall be established for proportions of basic remuneration or restricted stock compensation.

Process for Determining Remuneration

- The Nomination and Remuneration Committee composed of a majority of Outside Directors shall be established as an advisory body

to the Board of Directors.

This committee receives inquiries from the Board of Directors and also upon referring to objective data such as benchmark results of executive compensation provided by external specialist organizations the committee validates the appropriateness of the Director remuneration system that encompasses the basic remuneration payment standard, the bonuses to Directors calculation standard, and restricted stock compensation grant standard, and the results shall be reported to the Board of Directors. - The Chairman of the Board and Representative Director and the President and Representative Director shall be delegated with the authority to determine specific details for the amounts of individual remuneration for Directors based on a resolution of the Board of Directors.

- To ensure that the above delegated authority is properly exercised by the Chairman of the Board and Representative Director and the President and Representative Director, the Board of Directors shall consult with and obtain a report from the Nomination and Remuneration Committee on the payment standards, calculation method and grant standards for each type of remuneration by position and the Chairman of the Board and Representative Director and the President and Representative Director shall make their determinations in accordance with the contents of the relevant report, and shall report the results of the determined payment amount and the number of shares to be allotted to the Nomination and Remuneration Committee.

Audit & Supervisory Board Members

Items determined at General Meeting of Shareholders: Basic Remuneration of no more than 100 million yen per year (The 55th Ordinary General Meeting of Shareholders held on June 25, 2009)

Individual payment amounts are determined within the range of the above resolution upon consultation among Audit & Supervisory Board Members.

Total Amount of Remuneration to Directors and Audit & Supervisory Board Members (FY2022)

(Yen in millions)

| Classification | Amount of Remuneration | Basic Remuneration | Bonuses to Directors | Restricted Stock Compensation | |||

|---|---|---|---|---|---|---|---|

| Total amount | Persons paid (Persons) |

Total amount | Persons paid (Persons) |

Total amount | Persons paid (Persons) |

||

| Directors (excluding Outside Directors) |

390 | 145 | 12 | 191 | 6 | 54 | 6 |

| Outside Directors | 39 | 39 | 4 | ー | ー | ー | ー |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) |

48 | 48 | 2 | ー | ー | ー | ー |

| Outside Audit & Supervisory Board Members | 22 | 22 | 2 | ー | ー | ー | ー |

| Total | 499 | 254 | 20 | 191 | 6 | 54 | 6 |

(Note) Aside from the remuneration in the above table, the aggregate amount of remuneration to Directors (excluding Outside Directors) was 295 million yen in remuneration for services as employees or Executive Officers for those Directors who serve as such.

Cross-Shareholdings

Policy Regarding Cross-holding of Shares

Kyocera engages in cross-holding or unilateral holding of shares with the objective of improving our business value in the medium-to-long-term, focusing on corporate growth through maintenance of business relationships, realization of profits through shareholdings, and the issuing companies' social significance.

As a result of a yearly examination of its shareholdings, Kyocera reduces shares when it deems that holding such shares offers no significance. Kyocera founded Daini Denden Inc. (current KDDI Corporation) based on its management philosophy, "contributing to the advancement of society and humankind," and holds shares in KDDI Corporation. Kyocera plans to maintain its shares in KDDI Corporation to pursue a strategic alliance with the aim of increasing its corporate value over the medium-to-long-term.

Review of Cross-holdings of Shares

Kyocera Group Management Committee and our Board of Directors conduct an annual review of all cross-holdings including unilateral holdings of shares to assess whether continued holding of the relevant shares is appropriate, taking into account business needs, such as maintenance and/or enhancement of business relationships and efficiency in use of assets considering its cost of capital, with respect to individual shares. For any shares as to which a justifiable reason for holding them cannot be identified, Kyocera decreases our holdings of such shares through discussions with the issuing companies.

Exercise of Voting Rights

Kyocera exercises its voting rights represented by its holdings based on a comprehensive judgment, verifying whether each proposal continues to conform to Kyocera's shareholding policy and whether the issuing company's management policy and strategy remain consistent with the Kyocera's Management Rationale. Kyocera also examines whether each proposal submitted will contribute to a medium-to-long-term increase in corporate value and the common interests of shareholders, or whether it will cause a decrease in management efficiency or damage to Kyocera's financial health.

Fundamental Attitudes of Timely Disclosure

Kyocera, based on the ethical views stated in "The Kyocera Philosophy," believes that it is important to ensure a high degree of trust from its shareholders, investors and other stakeholders. For this purpose, Kyocera recognizes that sincere efforts to provide timely and appropriate disclosure of corporate information are indispensable and has accordingly established the following basic policies toward the disclosure of information.

- With respect to the disclosure of information, it shall be our policy to disclose both favorable information and unfavorable information timely in an equal and accurate manner.

- With respect to the disclosure of information, it shall be our policy to disclose information without delay and in a fair manner, with no bias towards the domestic or foreign, and without preference towards specific persons.

Corporate System for Timely Disclosure

Internal Control Audits of the Kyocera Group

Kyocera was listed on the New York Stock Exchange until June 26, 2018, and because of this, we had been among the companies to which Section 404 of the Sarbanes-Oxley Act applies. Section 404 requires business operators to construct and maintain internal control systems relating to fiscal reporting. It assesses the effectiveness of internal control systems through internal audits based on internal control evaluation criteria.As Kyocera voluntarily delisted its stocks from the New York Stock Exchange, we will assess the effectiveness of internal control systems based on the Companies Act and the Financial Instruments and Exchange Act (J-SOX rules).

Related Information

Corporate Motto / Management Rationale

- Top Management Message

- Kyocera Group's Value Creation Model

- Sustainability Management

- Priority Issues

- Kyocera Group CSR Guidelines

- Stakeholder Engagement

- Environmental Safety Policy / Targets and Promotion System

- Measures to Fight Climate Change -Information Disclosure Based on TCFD Recommendations-

- Water Risk Response

- Recycling Activities

- Initiatives to Prevent Environmental Pollution

- Conservation of Biodiversity

- Environmentally Friendly Products / Green Procurement

- Environmental Communication

- A History of Our Environmental Protection Activities

Social Citizenship Initiatives

- Human Capital

- Respect for Human Rights

- Promoting Diversity and Inclusion

- Occupational Safety

- Occupational Health, Safety, and Fitness Initiatives

- Supply Chain Management

- Approaches to Raising Quality and Customer Satisfaction Levels

- Social Contribution Activities

- Academic Advancement and Research

- Support for Culture and the Arts

- International Exchanges and Collaboration

- Environmental Protection Activities

- Local Community Activities

- Contributions to Society through Business Activities